Bitcoin: From humble beginnings to a global phenomenon, despite its issues

Electronic cash. That’s how the Bitcoin whitepaper, released in 2008, describes Bitcoin. From those simple beginnings through to today, Bitcoin has continued to grow in popularity and value.

In the last 13 years, Bitcoin has reached heights of over $67k (around 59k Euros), is held by over 106 million wallets, and in January 2022 had over 20k nodes, doubling the figure from 10 months previously.

But, as a form of electronic cash, it has always faced challenges.

While other cryptocurrencies have tried to challenge bitcoin’s mantle as the king, the development of the “Lightning Network”, first talked about in a whitepaper back in 2015, showed how Bitcoin can truly become a daily use payment system.

In May 2017, the first Lightning payment was made, and its popularity had grown until, in 2021, El Salvador started using the Lightning Network as part of its support of Bitcoin as a national currency.

CoinPayments, as well as offering support for multiple cryptocurrencies, gives you the ability to accept Bitcoin Lightning payments for your business. In this article, we’re going to cover exactly why Lightning Network exists, the problems it solves, and how your business can benefit from using it.

Fighting financial censorship in a digital world

In 2008, the world was facing a global banking crisis. People were unable to buy homes, get loans, or even withdraw their own money from banks that were facing serious financial issues.

This is why Bitcoin was created.

A “peer-to-peer electronic cash system” that removed the need for institutions who could censor your transactions, hold onto your money, or create this model of the flawed system again.

In terms of security and censorship resistance, it was second to none. A decentralised platform that anyone could use to buy, hold or create (through “mining”) money that could never be taken from them.

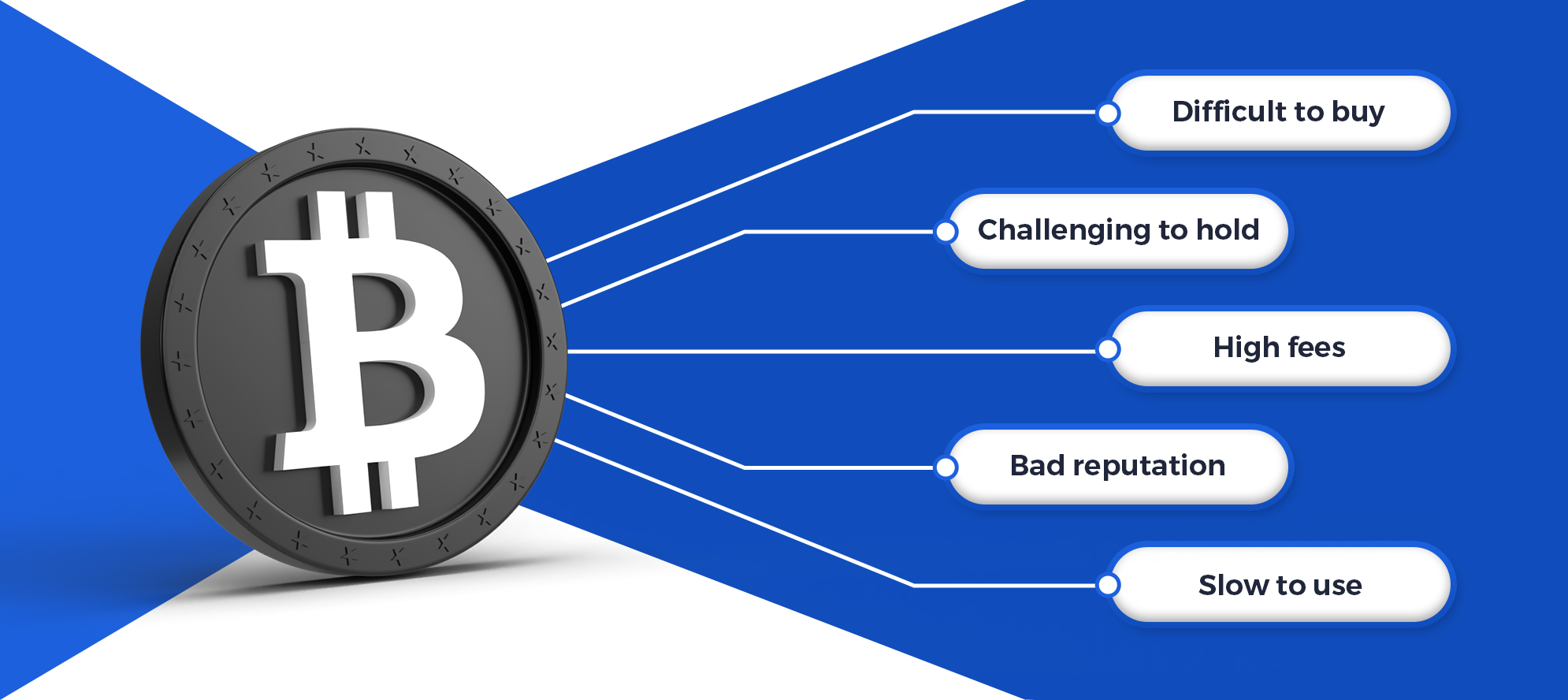

Unfortunately, the blockchain technology and methods Bitcoin uses to create these strengths, make it very different to the cash we are used to using daily.

Bitcoin was challenging to use, to hold, and even to buy, particularly for people who were not computer-literate. In comparison, we are used to using cash, and even bank-issued digital cash through debit cards, from a young age.

The decentralised nature, where multiple parties have to agree transactions are valid, is slow and data-intensive. Bank payments with a credit card are almost instant and when you are buying a cup of coffee you don’t want to wait potentially for an hour or more, or at least 10 minutes, for a Bitcoin transaction to confirm.

Finally, Bitcoin had a reputational issue. Despite its unsuitability for criminal activity, due to transactions being held “on-chain” forever and publicly visible, criminals did for a short period use it heavily, taking advantage of the lack of knowledge within law enforcement about the technology.

In 2013, CoinPayments was founded and since then we’ve made it our goal to enable businesses around the world to use Bitcoin and other cryptocurrencies in the way originally intended, as digital cash.

By giving merchants an easy way to set up and receive payments through systems they already use, while having the option to hold their crypto in their own wallet, or swap it back into their “fiat” currency of choice (such as EUR, GBP, or USD), we’ve helped solve the first issue of the need for technical knowledge.

By having 108,190 merchants and 1,032,721 wallet holders globally (as of February 2022), we’ve helped break the perception of Bitcoin as something used by criminals and helped bring it into the mainstream as something people can use daily and is accepted around the world.

But, there was one issue that was not so easy to solve, namely transaction speed.

CoinPayments do offer a range of cryptocurrency payment services, so businesses can choose to accept other, faster currencies for those quick transactions.

But they aren’t Bitcoin.

That’s why we integrated a Lightning payment system into the CoinPayments Platform. To allow businesses and holders to use their Bitcoin in the way they want, be that instant online digital deliveries, or for over-the-counter purchases when waiting for long transaction confirmations, simply isn’t practical.

The Lightning network, how does it work for Bitcoin?

Technically, the Lightning Network is a layer 2, bidirectional series of payment channels and smart contracts, which route using established peers so, in theory, Lightning will allow anyone to send payments to anyone else, once the network is big enough.

But, what does that actually mean?

A layer 2 network is simply a network built on top of another, in this case, Bitcoin to add extra features and functions. Bitcoin is layer 1 and provides the core functions such as security, Lightning is layer 2 and adds speed and ease of use.

Lightning works by creating an “off-chain” channel for transactions. The result of these transactions is not added to the main chain until the channel closes.

A Lightning channel is like a casino, but without the risk

When you arrive, you pay money and get chips. In effect, you have opened a payment channel with the casino.

You can then swap these tokens back and forwards between yourself and the house as many times as you want. This is what it means by “bidirectional”, that Lightning payments can move back and forwards between parties, it is not a one-way transfer.

Finally, you “cash out” of the casino by giving them back any chips you have, and you get money back in return. This is the same as closing a Lightning channel when the final balances, after all the Lightning transactions, are recorded as a single transaction on the layer 1 Bitcoin network.

In this way, a potentially unlimited number of transactions could happen in the Lightning channel, just as they could in a casino, but few are recorded on the main chain.

Where Lightning really comes into its own is the way it creates a “mesh” of users to connect distant users together to allow payments.

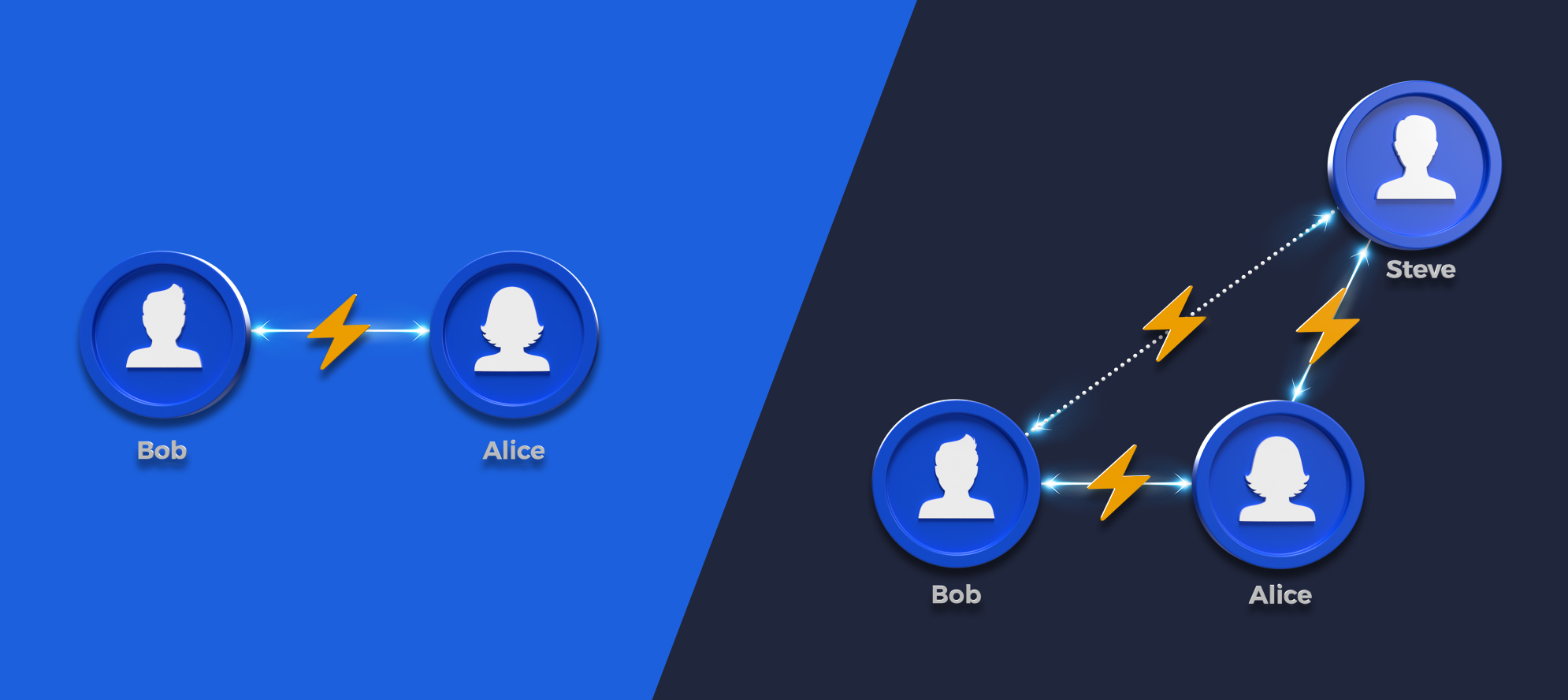

What this means is, normally Bob and Alice would need a Lightning channel directly between each other to exchange Bitcoin over the network. They would open the channel, exchange their Satoshis back and forth, and then close the channel to add the final transaction amount to the main Bitcoin network.

However, the routing means that you can send a payment to anyone else you can build a path to, even though you are not directly connected.

So, in the above example, Bob and Alice have a channel, but now Alice also has a separate Lightning channel with Steve.

Bob can now send Lightning payments to Steve, even though they are not directly connected, by routing them through Alice.

You can theoretically route through as many people as are connected, meaning payments can reach many more people and companies.

As more people use the service, the further the reach gets, and the increased likelihood you have of being able to send money, over Lightning, to the wallet you wish.

Creating a central hub that many other people use, such as CoinPayments, drastically increases the reach and effectiveness of the overall Lightning network.

How does Lightning improve Bitcoin?

Lightning both helps the overall Bitcoin network and improves the experience for users.

Bitcoin blocks, which are created roughly every 10 minutes, have a finite size. That is, they can only hold information about so many transactions. In order for miners to create these blocks, they pick the transactions which pay the highest fees.

This means, as popularity rises and more people are doing transactions on Bitcoin, you will need to pay a higher fee to get your transaction into a block, or you need to wait longer.

This is the scalability issue of Bitcoin, and there are other cryptocurrencies that have tried alternative methods to solve it.

In Bitcoin’s case, Lightning solves this by reducing the number of transactions requiring mining into blocks by only listing the transactions at the point of opening and closing Lightning channels.

A coffee shop chain that sells 100,000 cups of coffee per day (Starbucks sells over 8 million daily!) would create problems if it tried to run all those transactions through Bitcoin, but they could be handled easily by Lightning channels.

In a similar way for users, a fee of a couple of dollars on a transaction of several thousand dollars is very little, but as the Bitcoin network does not care about the value of a transaction, that same fee would be paid on each cup of coffee purchase.

For users paying for cheaper items, using Lightning makes perfect sense as it has massively reduced fees which are less prone to fluctuation compared to the main network fees.

The advantages of this are already being seen by users of services such as Twitter, who at the end of 2021 rolled out their “Tips” feature, which allows micro-payments to other users.

It is even being used at a country-wide level in El Salvador, which has Lightning payments integrated into their wallet as part of the acceptance of Bitcoin as a national currency.

CoinPayments and Bitcoin Lightning, a perfect combination

Our goal is to make it quick and easy for any business to accept crypto payments, so Lightning was a natural fit.

By connecting to us, any business can receive Bitcoin Lightning payments from a customer connected to any other business that is also connected to us.

This creates a huge mesh of users able to transfer Bitcoin quickly, easily, and cheaply without the potential large fees or wait times normally associated with Bitcoin.

Our network of tens of thousands of merchants globally, allows you to open up your customer base to a global platform of prospective customers already used to using cryptocurrencies and looking for companies to spend them with.

Our Lightning service is also compatible with any Lightning wallet, meaning your customers won’t have to download or install any new software, they just connect using the wallets they already know and trust.

Of course, we also offer full support to our clients in setting up their own Lightning payments as our goal is to bring wider cryptocurrency adoption, and we know some of you might need a little support along the way.

How can I start accepting Bitcoin Lightning payments?

If you are already a CoinPayments merchant, congratulations! You are only a couple of steps away from upgrading your service to your customers by offering them instant, low-cost payments via Lightning.

To turn on Lightning payments, visit the coin settings page. While there, be sure to update your coin settings for new projects we now have available, including a host of Tron and Solana supported stable coins.

In just minutes, you can be up and running, offering new payment options to your customers.

If you need any additional support in setting up Lightning or other coin payments, you can also get in touch here and our team will be happy to help you.

If you aren’t yet a CoinPayments merchant, and you would like to take advantage of accepting Lightning payments through Bitcoin (as well as your choice from all the popular cryptocurrencies), visit our sign-up page to find out more.